The key to economic growth in Iowa is also one of the largest challenges for our employers—building a highly skilled workforce. Because of this, Governor Reynolds has made preparing Iowa’s next-generation workers one of her top priorities. The state has made headway through strategic investments in work-based learning, registered apprenticeship programs, housing, broadband and child care.

Governor Reynolds proposes to build on that headway through:

Medicaid Work Requirements

Iowa’s government programs reflect a culture of work. From promoting training programs to turning our unemployment system into a reemployment system, Governor Reynolds has introduced programs and laws that have succeeded in making sure more Iowans wake up in the morning with a sense of purpose.

Some of these efforts, though, have been hampered by a federal government that often pays people to stay home.

The Governor is proposing that Iowa apply for a federal waiver to institute work requirements for able-bodied adults on Medicaid. For the men and women who are receiving these government payments, getting back to work can be a lifeline to stability and self-sufficiency.

Teacher Para Registered Apprenticeship

Iowa’s first-in-the-nation Teacher Para Registered Apprenticeship program (TPRA) supports over 1,081 future teacher and paraeducators over 123 school districts. Because it received such positive response, the Governor reopened the grant for a second round and now proposes to simplify requirements for participation by:

- Removing the requirement for a paraeducator certificate

- Adjusting restrictions related to the teacher intern pathway

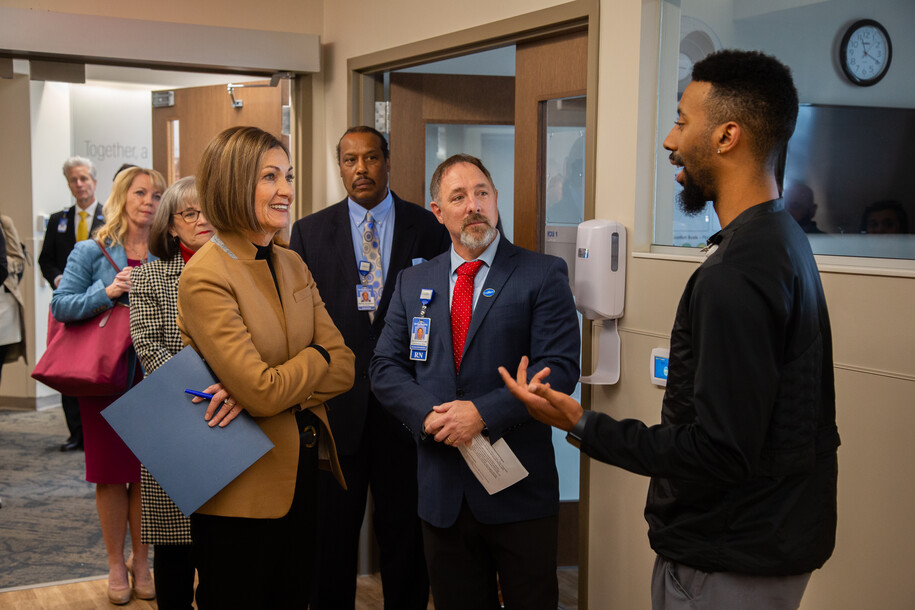

Health Care Credentialing Grants

Iowa needs more nurses, CNAs, and LPNs. To address this growing issue, the Governor is making available $3 million in Health Care Credentialing grants for employers to train and educate people in these areas. This program provides more flexibility for employers and will help fill in-demand health careers.

Unemployment Insurance Reform

Attracting investment from both new and existing businesses requires a competitive tax and regulatory environment. While our corporate rate is on its way down from 12% to 5.5%, our individual rate is at a flat 3.8%, and we’ve cut over 1,200 state regulations, our unemployment insurance system must be reformed to keep Iowa competitive. According to the Tax Foundation’s State Business Tax Climate Report, the best states for unemployment taxes have lower rates and less complex systems than Iowa. In addition, Iowa’s taxable wage base is the 2nd highest in the Midwest.

Currently, the average duration of unemployment claims in Iowa is at an all-time low of 9.0 weeks. At the same time, Iowa’s Unemployment Trust Fund balance is at an all-time high of $1.8 billion, the 9th highest in the nation. As the 32nd most populous state, this balance far exceeds what is needed to support Iowans. We are over-collecting on Iowa businesses. If we lower unemployment taxes, businesses will be able to hire more employees, increase wages, and decrease usage of the unemployment system.

GOV. REYNOLDS PROPOSES:

- Decrease the taxable wage base by half

- Lower the maximum tax rate to 5.4% in all tax tables

- Simplify the unemployment tax system by reducing the number of tax tables

- Encourage businesses to reinvest savings into their employees